About

LILIUM CAPITAL SPECIALIZES IN STANDARD FINANCIAL INTER-MEDIATION SEEKING TO MATCH INTERNATIONAL INVESTOR RISK APPETITE WITH DOMESTIC FUNDING NEEDS IN FRONTIER MARKETS, IN TERMS OF THE PRINCIPAL COMPONENTS OF THE VALUE CHAIN - ORIGINATING, STRUCTURING AND DISTRIBUTING FRONTIER MARKET RISK TRANSACTIONS.

Since frontier market capital markets are not yet well developed, but are developing rapidly, it makes sense to focus on where risk appetite is most likely to blend, including:

- Sovereign funding, which attaches the largest and most liquid sources of investment risk.

- Corporate funding, given both strong growth and bank lending regulatory restrictions (where Single Obligor Limits and constrained bank balance sheets from higher capitalization requirements has boosted 'shadow banking' prospects in many frontier markets.

- Infrastructure project finance and hard asset financing, such as real estate funding.

While Lilium Capital is seeking to meet investor risk and funding needs across the capital structure, the bias is expected to fall on debt capital markets (DCM) given the primary debt characteristics of frontier market finance.

FRONTIER MARKETS

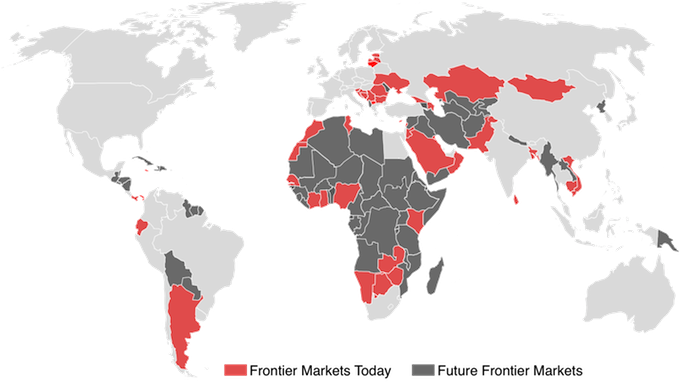

A frontier market is an economic term coined by the International Finance Corporation in 1992 commonly used to describe a subset of emerging markets with much less developed economies and capital markets. Frontier markets are ‘investable’, but have lower bond and equity market capitalization and liquidity and turnover than established emerging markets. Frontier markets are typically pursued by investors seeking high, long term returns and low correlations with other markets. The implication of a country being labeled as frontier is that, over time, the market will become more liquid and exhibit similar risk and return characteristics as the larger, more liquid developed emerging markets. Frontier markets are more organized as an asset class in listed equities than in fixed income markets given the former’s classification on qualifying criteria for inclusion in 'investable' indices, notably the MSCI suite of frontier market funds. The inclusion discretion of a market as ‘frontier’ is thus typically greater for dedicated fixed income vs. dedicated listed equity international investors. Below is a map of dedicated index qualifying equity markets, showing examples of frontier markets today and future frontier markets.

NEW OPPORTUNITIES

Frontier markets are mostly characterized by rapid GDP growth and, as a result, rising funding needs. By matching investment demand with supply, Lilium Capital is able to bridge this funding gap and, in so doing, help to deepen local currency sovereign debt markets; provide local corporate entities access to the international capital markets and facilitate financing of infrastructure projects. On the demand side, a quest for both diversification (to reduce portfolio beta) and yield (to enhance portfolio alpha) will likely see more investors allocating capital 'down the risk curve' into sovereign local currency funding as well as corporate financing opportunities and more direct infrastructure funding that have hitherto not been generally available given that these frontier market sectors are relatively undeveloped. On the supply side, two types of corporates will likely be seeking funding solutions:

- In fast growing frontier economies, local funding sources are limited. As local economies diversify, indigenous companies will increasingly need to look to offshore investors as a viable funding source for their incremental capital raising needs.

- Equally, the prospect of rising per capita incomes in economically diversifying frontier markets will also attract ever more International companies, many of whom will seek to match their Treasury funding on a market-matched basis, seeking to raise their incremental capital from outside a parent balance sheet from both local and offshore investors.

CORE COMPETENCE

Based on his career experience in frontier markets and academic expertise in Finance and Economics, Lilium Capital’s Managing Leadership is seeking to optimize the initial senior staff complement to incorporate the following four core competencies:

- Geographic Knowledge of Frontier Markets

Senior team members have either lived, worked or visited extensively in frontier markets, especially sub-Sahara Africa and Latin America including frequent research trips to these countries for the past several years. - An Extensive and High Profile Network of Contacts

This ensures ready and efficient access to key decision makers in frontier markets in the government, corporate, banking and Development Finance Institutions (DFI) sectors. - Product Knowledge of Global Investment Banking

Origination, Structuring (incl. legal work) and Distribution of assets from frontier markets to global investors; Trading a frontier market FX, fixed income and credit derivative client and proprietary book; Fund Managing frontier market multi-asset portfolios including FX, fixed income and equities. - Market Intelligence and International Investor Access

Either through the team’s own network or via best-in-class distribution agents to ensure that assets are targeted to investors with a proven and repeatable risk appetite for frontier market exposure.

As a firm, we are committed to supporting impactful change and progress in the regions in which we work. We recognize that the increasing convergence and interconnectedness of global markets, local people and regional economies are the fundamental drivers of global security and social improvement.